Fund formation

We act as drafting/lead counsel for our clients in respect of establishing and launching both open-ended and closed-end private funds. In particular, we:

- analyse and determine the optimal structure of funds and fund management platform in view of their short-term and long-term business plans;

- draft, negotiate and revise offering documents for private funds with various investment strategies, including without limitation:

- hedge funds;

- private equity funds (PE funds);

- venture capital funds (VC funds);

- credit funds;

- distressed asset funds;

- pre-IPO investment funds;

- single project funds; and

- co-investment funds;

- draft, negotiate and revise offering documents for funds adopting different structures, including without limitation:

- Hong Kong limited partnership fund (HK LPF);

- Cayman Islands exempted limited partnership (Cayman ELP);

- British Virgin Islands limited partnership (BVI LP);

- Hong Kong open-ended fund company (HK OFC); and

- Cayman Islands Segregated Portfolio Companies (Cayman SPC);

- lead the fund launch process, including liaising and coordinating with the client’s appointed auditors, tax advisers, administrators, prime brokers, custodians and other local/specialist counsels in respect of determining the optimal fund structure and preparing and finalising the offering documents of the funds.

HKLPF formation

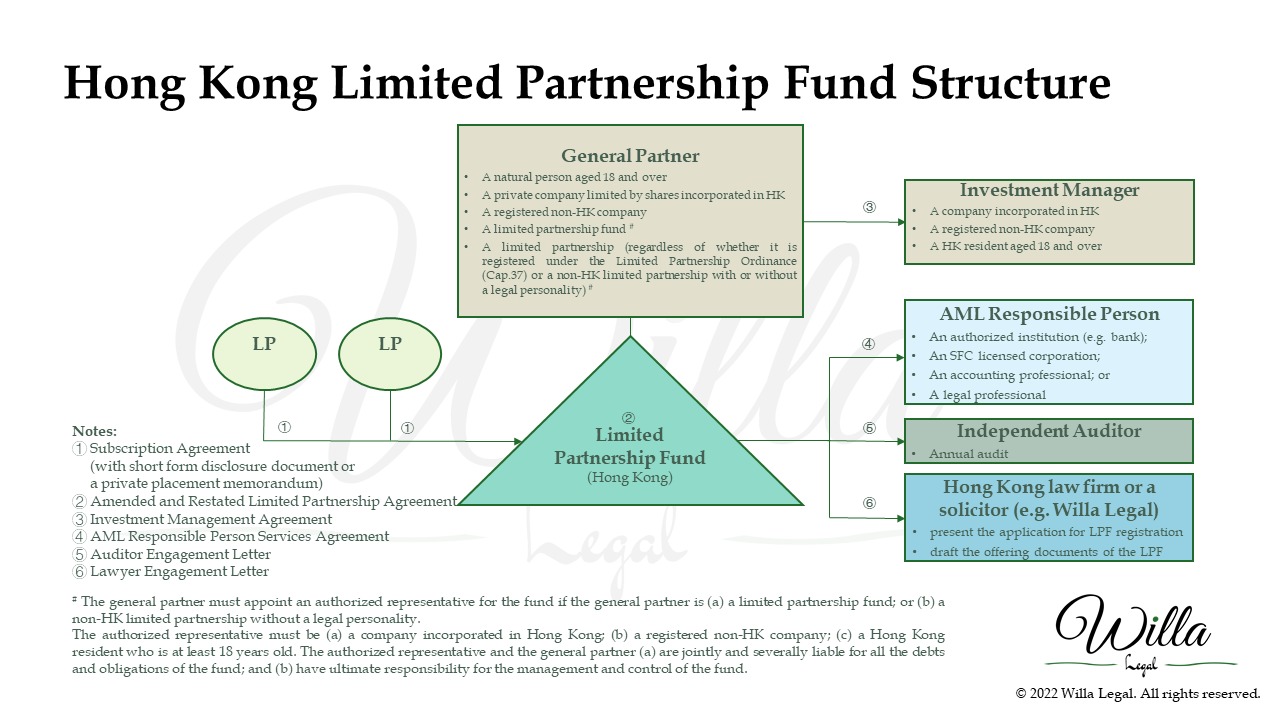

Hong Kong limited partnership funds (HKLPFs) are used primarily for closed-end funds (e.g. private equity funds, venture capital funds, pre-IPO investment funds and single project funds). Nevertheless, HKLPFs can also be used as a structure for open-ended funds.

When a client wishes to establish a Hong Kong limited partnership fund (HKLPF), we are the Hong Kong solicitors submitting the HKLPF registration on behalf of the client. We also act as the drafting/lead counsel for our clients in respect of establishing and launching the HKLPF. In particular, we:

- advise on the necessary service providers and parties involved in the establishment and launch of the HKLPF, including the management and shareholding structure of the general partner (GP) and the investment manager (IM) and, if necessary, the composition of the investment committee (IC);

- prepare the initial agreements, registration application and resolutions for the registration of the HKLPF;

- submit the registration application to the Hong Kong Companies Registry on behalf of our client;

- draft, negotiate and revise the offering documents of the HKLPF in anticipation for fund launch, including without limitation, the amended and restated limited partnership agreement (ARLPA), a pro forma subscription agreement, a short form disclosure document or a private placement memorandum, and side letters;

- draft the investment management agreement and anti-money laundering responsible person service agreement; and

- draft launch resolutions of the GP and handle closing logistics with the client and the investors (i.e. the limited partners), including preparing the final versions of the offering documents and the signing instructions.

Following the launch of the HKLPF, we also advise on any compliance or filing requirements in respect of the HKLPF.

Below is a general structure chart of a HKLPF:

Fund raising

When a fund manager is marketing its funds to potential investors (whether in respect of the first closing or subsequent closings of their funds), we:

- review non-disclosure agreements (NDAs), marketing materials and pitchbooks;

- review the client’s answers and input to the due diligence questionnaires required by the investors;

- negotiate and revise side letters;

- coordinate closing and investor admission with the fund administrator;

- revise offering documents to the extent necessary for admission of additional investors;

- advise on investor consent issue and amendment mechanisms in respect of the offering documents; and

- review, advise on and coordinate the process of most favoured nation (MFN) election.

Fund operation

After the fund is launched and is in operation, we:

- update the offering documents to reflect legal and regulatory changes;

- advise on, structure and draft offering documents of co-investment vehicles, parallel funds and alternative investment structures;

- draft documents for transfer or switch of investors’ shares/interests in funds; and

- draft and review answers and responses to the requisitions and questions from the Securities and Futures Commission (SFC) on the fund offering documents and the management and operation of the fund.

Seed investment

Sometimes, a fund may have an anchor investor or a seed investor, who, in addition to having preferential investment terms in the fund, also takes an equity or revenue share in the fund management platform. In these cases, we help our clients to:

- negotiate and document upstream management and shareholding arrangements of the founders, their team and seed investors;

- draft and prepare the shareholders agreement, revenue sharing agreement or other agreements appropriate to document the arrangements; and

- draft and negotiate the side letter, or advise on share class structuring and disclosure issues.

Investing in a fund

We have worked on a wide range of fund products and discretionary/managed accounts that have different investment strategies and structures. If a client is investing in a fund, we will help the clients:

- review offering documents from investors’ perspective, including drafting issues list for discussion and negotiation with fund counsel; and

- negotiate and draft/revise side letters.

Non-contentious securities regulatory advice

The fund management sector is regulated by the Hong Kong Securities and Futures Commission (SFC). From the establishment of the fund management platform to the launch and ongoing operation of funds that are managed by SFC licensed fund managers, our clients would need securities law related advice. In those scenarios, we work with our clients to navigate and handle the non-contentious financial regulatory issues regarding the funds and fund management platform. Common issues that we deal with include:

- the SFC licensing requirements applicable to fund managers (regardless of whether they are hedge or private equity fund managers);

- the private placement and SFC authorisation regime in Hong Kong;

- marketing interest in funds to investors in Hong Kong (whether by a local manager or a foreign manager);

- disclosure and compliance requirements set forth in the SFC codes, guidelines and circulars, including the Fund Manager Code of Conduct;

- professional investor categorisation; and

- requisitions and questions following a routine SFC inspection.